Duty Tax on Shipments to Japan as Gift Delivery: A Comprehensive Guide

Win a Free Trip to Japan!

Experience cherry blossoms and ancient temples

Are you planning to send a thoughtful gift to your loved ones in Japan?

Navigating the intricacies of duty tax on shipments to Japan can be a bit daunting, but with our comprehensive guide, you’ll be well-equipped to handle these charges seamlessly.

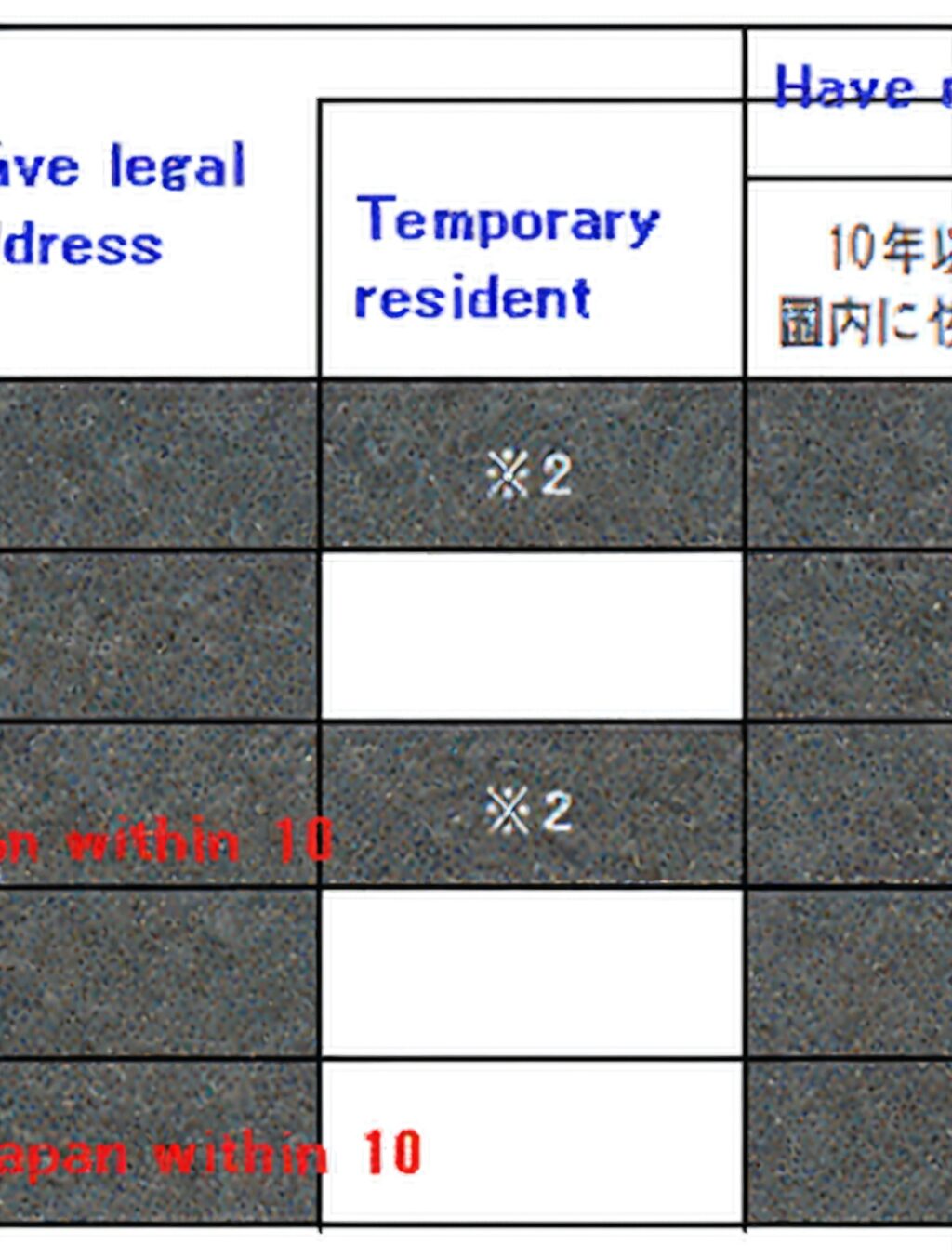

When it comes to sending gifts valued at JPY 10,000 or less, you’re generally in the clear, as Japan grants duty-free entry for personal use items. However, for gifts exceeding this threshold, you may encounter some additional expenses.

Understanding Tax Rates and Exemptions:

- General Duty Rate: Shipments valued between JPY 10,000 and 200,000 are subject to a flat duty rate of 8%.

- Exemptions: Certain items, such as books, magazines, and educational materials, are exempt from duty tax.

Steps to Calculate Duty Tax:

- Determine the value of your gift, including shipping costs.

- Subtract JPY 10,000 from the value to calculate the taxable amount.

- Multiply the taxable amount by the applicable duty rate.

Tips for Minimizing Duty Taxes:

- Split Shipments: Divide your gift into smaller shipments to avoid exceeding the JPY 10,000 threshold.

- Consider Duty-Free Items: Focus on sending items that are exempt from duty tax.

- Declare Gifts Honestly: Always declare the contents and value of your gift on the customs form to avoid any discrepancies.

FAQs:

- Who is responsible for paying duty tax? The recipient of the gift is typically responsible for paying the duty tax.

- Can I pay duty tax in advance? Yes, it is possible to prepay duty tax through certain shipping carriers.

- What happens if I don’t pay duty tax? Unpaid duty tax may result in the shipment being held by customs or returned to the sender.

Understanding duty tax on shipments to Japan is crucial to avoid any surprises. By following these guidelines and being mindful of the applicable rules and regulations, you can ensure your gift delivery reaches its destination smoothly and without any unnecessary hassles.